The {fHMM} R package allows for the detection and

characterization of financial market regimes in time series data by

applying hidden Markov Models (HMMs). The vignettes outline the

package functionality and the model formulation.

For a reference on the method, see:

Oelschläger, L., and Adam, T. 2021. “Detecting Bearish and Bullish Markets in Financial Time Series Using Hierarchical Hidden Markov Models.” Statistical Modelling. https://doi.org/10.1177/1471082X211034048

A user guide is provided by the accompanying software paper:

Oelschläger, L., Adam, T., and Michels, R. 2024. “fHMM: Hidden Markov Models for Financial Time Series in R”. Journal of Statistical Software. https://doi.org/10.18637/jss.v109.i09

Below, we illustrate an application to the German stock index DAX. We also show how to use the package to simulate HMM data, compute the model likelihood, and decode the hidden states using the Viterbi algorithm.

You can install the released package version from CRAN with:

install.packages("fHMM")We are open to contributions and would appreciate your input:

If you encounter any issues, please submit bug reports as issues.

If you have any ideas for new features, please submit them as feature requests.

If you would like to add extensions to the package, please fork

the master branch and submit a merge request.

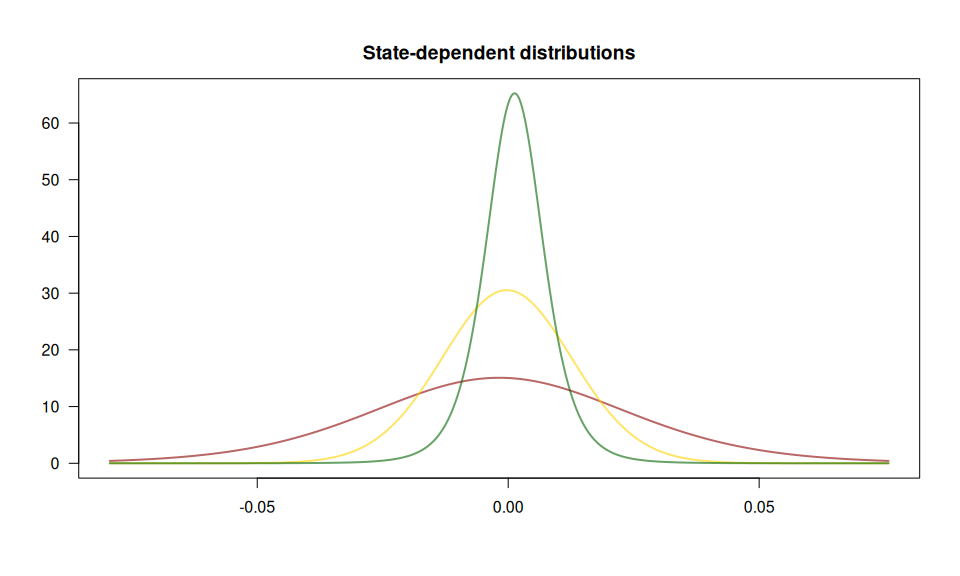

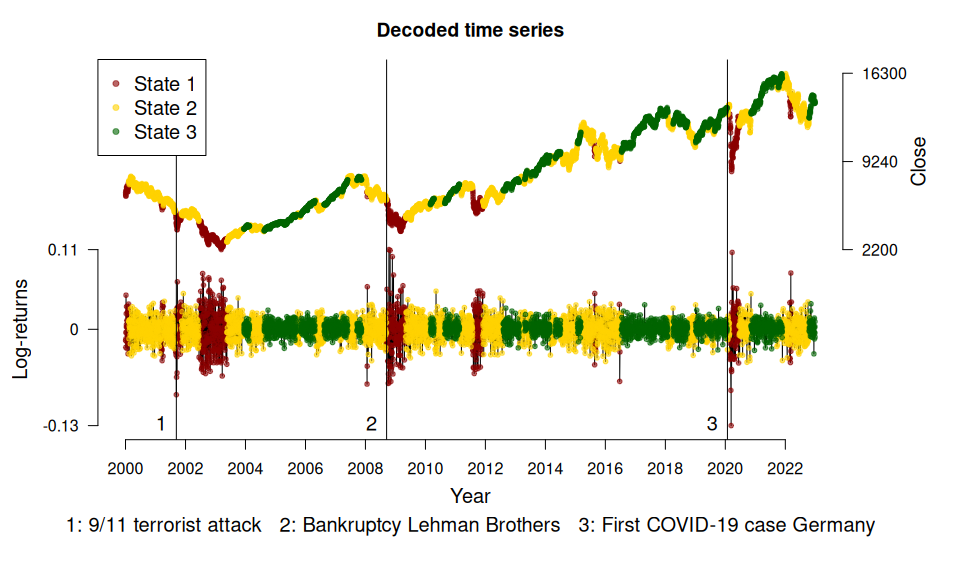

We fit a 3-state HMM with state-dependent t-distributions to the DAX log-returns from 2000 to 2022. The states can be interpreted as proxies for bearish (green below) and bullish markets (red) and an “in-between” market state (yellow).

library("fHMM")The package has a build-in function to download financial data from Yahoo Finance:

dax <- download_data(symbol = "^GDAXI")We first need to define the model:

controls <- set_controls(

states = 3,

sdds = "t",

file = dax,

date_column = "Date",

data_column = "Close",

logreturns = TRUE,

from = "2000-01-01",

to = "2022-12-31"

)The function prepare_data() then prepares the data for

estimation:

data <- prepare_data(controls)The summary() method gives an overview:

summary(data)

#> Summary of fHMM empirical data

#> * number of observations: 5882

#> * data source: data.frame

#> * date column: Date

#> * log returns: TRUEWe fit the model and subsequently decode the hidden states and compute (pseudo-) residuals:

model <- fit_model(data)

model <- decode_states(model)

model <- compute_residuals(model)The summary() method gives an overview of the model

fit:

summary(model)

#> Summary of fHMM model

#>

#> simulated hierarchy LL AIC BIC

#> 1 FALSE FALSE 17650.02 -35270.05 -35169.85

#>

#> State-dependent distributions:

#> t()

#>

#> Estimates:

#> lb estimate ub

#> Gamma_2.1 2.754e-03 5.024e-03 9.110e-03

#> Gamma_3.1 2.808e-16 2.781e-16 2.739e-16

#> Gamma_1.2 1.006e-02 1.839e-02 3.338e-02

#> Gamma_3.2 1.514e-02 2.446e-02 3.927e-02

#> Gamma_1.3 5.596e-17 5.549e-17 5.464e-17

#> Gamma_2.3 1.196e-02 1.898e-02 2.993e-02

#> mu_1 -3.862e-03 -1.793e-03 2.754e-04

#> mu_2 -7.994e-04 -2.649e-04 2.696e-04

#> mu_3 9.642e-04 1.272e-03 1.579e-03

#> sigma_1 2.354e-02 2.586e-02 2.840e-02

#> sigma_2 1.225e-02 1.300e-02 1.380e-02

#> sigma_3 5.390e-03 5.833e-03 6.312e-03

#> df_1 5.550e+00 1.084e+01 2.116e+01

#> df_2 6.785e+00 4.866e+01 3.489e+02

#> df_3 3.973e+00 5.248e+00 6.934e+00

#>

#> States:

#> decoded

#> 1 2 3

#> 704 2926 2252

#>

#> Residuals:

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> -3.517900 -0.664018 0.012170 -0.003262 0.673180 3.693568Having estimated the model, we can visualize the state-dependent distributions and the decoded time series:

events <- fHMM_events(

list(dates = c("2001-09-11", "2008-09-15", "2020-01-27"),

labels = c("9/11 terrorist attack", "Bankruptcy Lehman Brothers", "First COVID-19 case Germany"))

)

plot(model, plot_type = c("sdds","ts"), events = events)

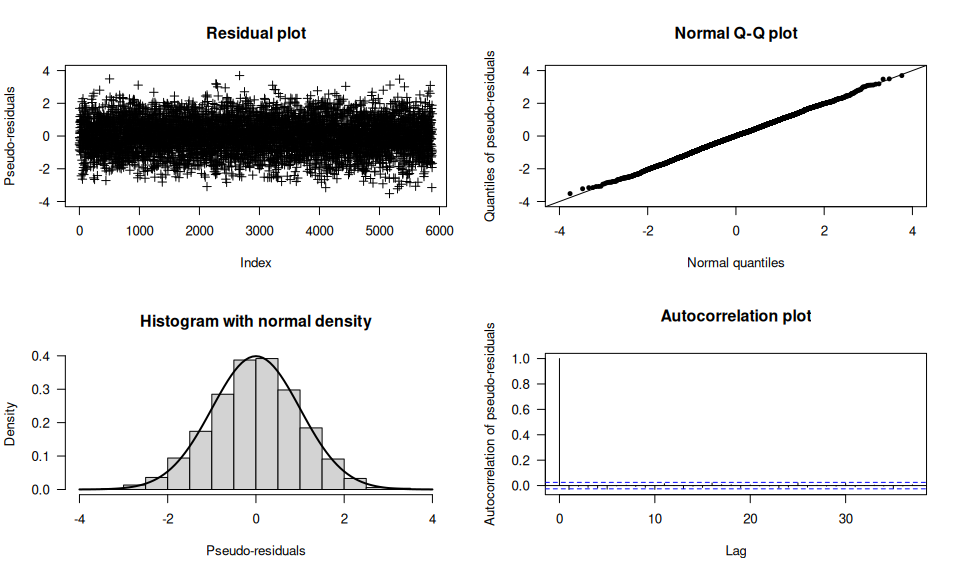

The (pseudo-) residuals help to evaluate the model fit:

plot(model, plot_type = "pr")

The {fHMM} package supports data simulation from an HMM

and access to the model likelihood function for model fitting and the

Viterbi algorithm for state decoding.

controls <- set_controls(

states = 2,

sdds = "gamma",

horizon = 1000

)fHMM_parameters()

function (unspecified parameters would be set at random).par <- fHMM_parameters(

controls = controls,

Gamma = matrix(c(0.95, 0.05, 0.05, 0.95), 2, 2),

mu = c(1, 3),

sigma = c(1, 3)

)simulate_hmm() function.sim <- simulate_hmm(

controls = controls,

true_parameters = par

)

plot(sim$data, col = sim$markov_chain, type = "b")

ll_hmm() is evaluated at

the identified and unconstrained parameter values, they can be derived

via the par2parUncon() function.(parUncon <- par2parUncon(par, controls))

#> gammasUncon_21 gammasUncon_12 muUncon_1 muUncon_2 sigmaUncon_1

#> -2.944439 -2.944439 0.000000 1.098612 0.000000

#> sigmaUncon_2

#> 1.098612

#> attr(,"class")

#> [1] "parUncon" "numeric"Note that this transformation takes care of the restrictions, that

Gamma must be a transition probability matrix (which we can

ensure via the logit link) and that mu and

sigma must be positive (an assumption for the Gamma

distribution, which we can ensure via the exponential link).

ll_hmm(parUncon, sim$data, controls)

#> [1] -1620.515ll_hmm(parUncon, sim$data, controls, negative = TRUE)

#> [1] 1620.515ll_hmm() over parUncon

(or rather minimize the negative log-likelihood).optimization <- nlm(

f = ll_hmm, p = parUncon, observations = sim$data, controls = controls, negative = TRUE

)

(estimate <- optimization$estimate)

#> [1] -3.46338992 -3.44065582 0.05999848 1.06452907 0.11517811 1.07946252parUncon2par()

function. The state-labeling is not identified.class(estimate) <- "parUncon"

estimate <- parUncon2par(estimate, controls)

par$Gamma

#> state_1 state_2

#> state_1 0.95 0.05

#> state_2 0.05 0.95estimate$Gamma

#> state_1 state_2

#> state_1 0.96895125 0.03104875

#> state_2 0.03037204 0.96962796

par$mu

#> muCon_1 muCon_2

#> 1 3estimate$mu

#> muCon_1 muCon_2

#> 1.061835 2.899473

par$sigma

#> sigmaCon_1 sigmaCon_2

#> 1 3estimate$sigma

#> sigmaCon_1 sigmaCon_2

#> 1.122073 2.943097